Company InformationPure Investment Overview

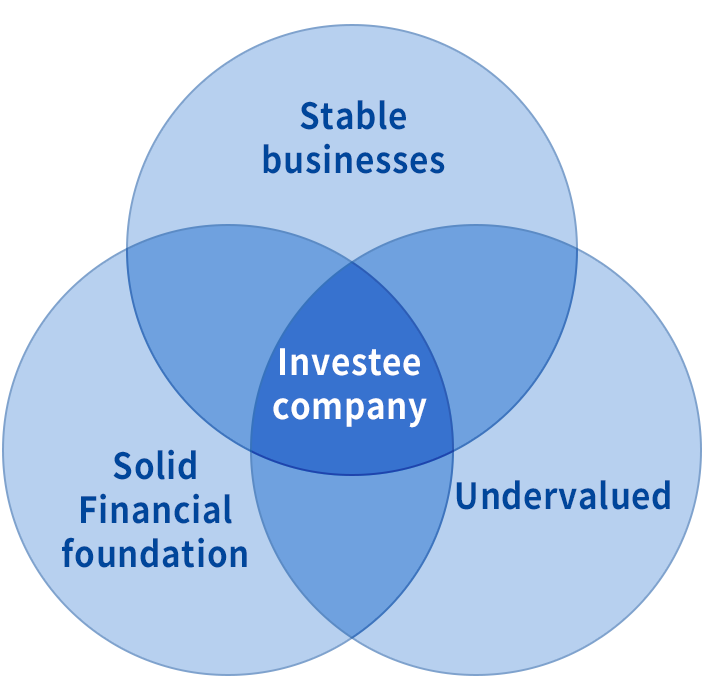

Stock Selection Criteria

The guiding principle that we live by is to hold stocks

for a long period of time, aiming at forging a pleasant

relationship with investees based on the idea that

purchasing stocks is having a part of ownership of the

company in which we have stakes.

We focus on

running stable businesses and acquiring the stock of

blue-chip companies with financial soundness at a

reasonable price.

Characteristic of Our Stock Investment

| Example of funds | The Company | ||

|---|---|---|---|

| Recognition of investment targets | Financial products | Business | Judgment is not based on market trends |

| Investment period | With a deadline | Without a deadline | Partial holding of companies we want to work with indefinitely |

| Maximum holding ratio | Yes | No | Possible to operate as a consolidated subsidiary as a business company |

| Liquidity of stocks | Avoid low-liquidity investments | Regardless of liquidity | We can invest even in low-liquidity stocks |

| KPI | Stock price-based investment performance | EY | Not affected by stock price fluctuations (market prices) |

※横スクロールで全体を表示します。

Main Indicator

Billion JPY

| 21/3 | 22/3 | 23/3 | 24/3 | 25/3 | ||

|---|---|---|---|---|---|---|

| Investment book value (A) | 357.3 | 456.0 | 532.6 | 590.2 | 725.4 | |

| Unrealized Gain | 148.4 | 162.0 | 226.6 | 411.1 | 444.6 | |

| Market value | 505.8 | 618.0 | 759.2 | 1,001.3 | 1,170.0 | |

|

Look-through Earnings (B) (last 12 months) |

44.6 | 70.8 | 80.3 | 83.2 | 114.8 | |

| Earnings Yield (B) ÷ (A) | 12.5% | 15.5% | 15.1% | 14.1% | 15.8% | |

|

Dividend yield (based on CF and book value, last 12 months) |

2.7% | 3.0% | 3.4% | 4.1% | 3.9% | |

| Dividend Income (P/L) (C) | 7.3 | 10.6 | 14.5 | 18.6 | 21.5 | |

| Pre-tax realized gain (comprehensive income) (D) | 10.8 | 13.9 | 16.2 | 54.6 | 25.7 | |

| Total (C)+ (D) | 18.1 | 24.6 | 30.7 | 73.2 | 47.2 | |

※横スクロールで全体を表示します。

* “Look-through earnings” is calculated by multiplying

operating profit of each of the companies we invested in

by our stock holding ratio and adding all them up.

* “Last 12 months” means four quarters of the last 12

months from the record date for which financial results

have been announced.